Tax-Planning in Retirement™ at UTA – Apr03

Taxes can be one of your biggest expenses in retirement, and understanding how to minimize them can significantly impact your financial future. This class will equip you with actionable strategies to reduce your tax burden, optimize your retirement withdrawals, and take advantage of deductions, credits, and other opportunities you might not even know exist. Whether you’re planning for retirement, managing investments, or thinking about leaving a legacy, you’ll gain valuable insights to help you keep more of your wealth while staying on the right side of the tax laws.

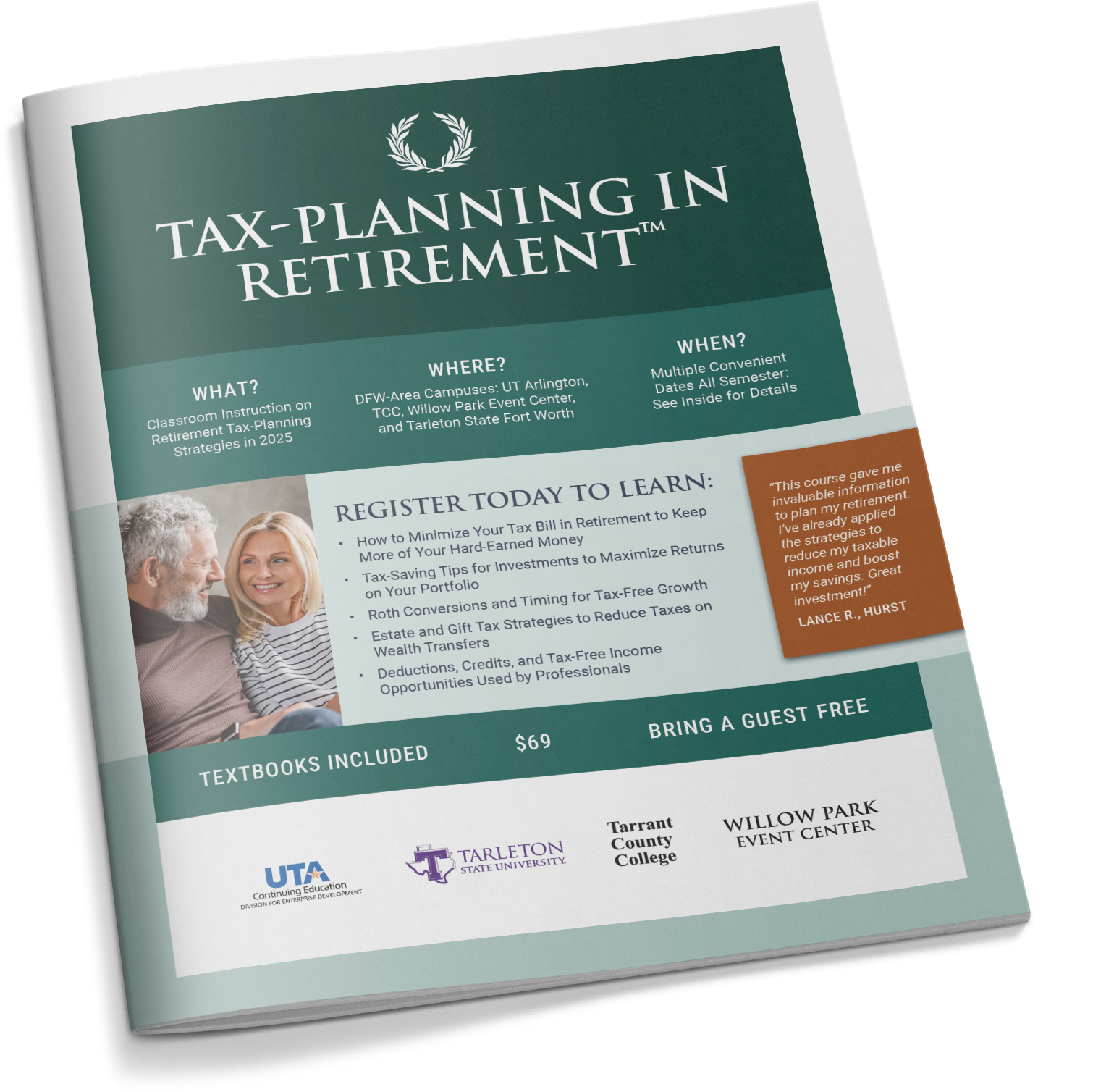

Register to learn:

- How to Minimize Your Tax Bill in Retirement to Keep More of Your Hard-Earned Money

- Tax-Saving Tips for Investments to Maximize Returns on Your Portfolio

- Roth Conversions and Timing for Tax-Free Growth

- Estate and Gift Tax Strategies to Reduce Taxes on Wealth Transfers

- Deductions, Credits, and Tax-Free Income Opportunities Used by Professionals

This course has valuable information for everyone. We discuss strategies to optimize withdrawals from taxable, tax-deferred, and tax-free accounts to keep more of your hard-earned money.

You will learn how to create a personalized plan to minimize taxes in retirement, maximize tax-efficient investments, and leverage deductions and credits to save more.